Accounting is a broad field and it’s okay if you don’t know everything. Especially if you are just starting your business. And not only you but 60% of business owners like you are not confident about their accounting knowledge.

And that is mostly because it is quite a steep learning curve for small business owners and especially for contractors. Therefore, we should take one step at a time. And today, it is credit memo vs invoice. Let’s learn the difference, the similarity, and how to use both for the most effective accounting process without investing in accounting software.

Table of Content

So, if you want to differentiate any two things, you must learn both of them inside out separately. Hence, let’s learn what a credit memo and an invoice are, individually.

The term credit memo is the abbreviated form of the credit memorandum. It is also known as a credit note.

The textbook definition of the credit memo is an accounting document that is issued by the seller to the customer to notify them of their positive balance in the account.

In simpler words, whenever the customer has paid more than the worth of services or goods he/she got, the company issues a credit note to reflect the same.

Still confused? Let’s understand it with a credit memo example.

A customer of yours hired you for renovating his bathroom. You had an agreement on the estimated price of $10,000, which he had paid you in advance. Now, for some reason, the project got completed for just $9000.

So, you will have to create a credit memo to acknowledge the extra $1000 of positive balance he has.

Now, you must be thinking what are those scenarios that create a need for issuing credit memos, right?

So, let’s discuss when you need to issue credit memos.

Your accounts payable department needs to create credit memos in many situations. So, you must know when to issue credit memos.

Basically, whenever the seller owes money back to the customer, the seller needs to create a credit memo. You can use a credit memo maker to quickly prepare credit memos.

But can’t he/she just tell the customer about the same thing over a phone call?

Umm no! And here’s why.

Well, that’s right that the contractor can simply inform about the positive credit balance over a phone call but that’s not the only purpose of a credit memo. So, let’s know more about it.

Now, if you have understood the concept of credit memos, let’s talk about the invoice.

An invoice is a legally binding accounting document that is issued by the seller to the customer for requesting the payments for the goods/services provided. While this is the primary purpose, it has multiple secondary purposes too, which we will discuss in this blog shortly.

An invoice helps the customers know how much they owe to the vendor, what they need to pay, when they are expected to pay, and how to pay the due.

Therefore, an invoice is mandatory to produce for every business transaction.

A contractor needs to create and send invoices at several instances during the time of the contract. This highly depends on the contract and the prior agreement between you and your client.

However, we will discuss the most common times to send invoices and you can choose the one which suits your business.

In a nutshell, it is issued whenever the vendor wants to request money. Now, if you want to save time and get them approved quickly, make invoices online.

Creating an invoice is among the first things accountants need to learn because it has multiple purposes that can benefit the business and the client. So, let’s learn a few of them.

See, that’s why every business should keep the invoicing process updated. If you find your invoice process complex and tiresome, signup to InvoiceOwl and create professional-looking invoices now!

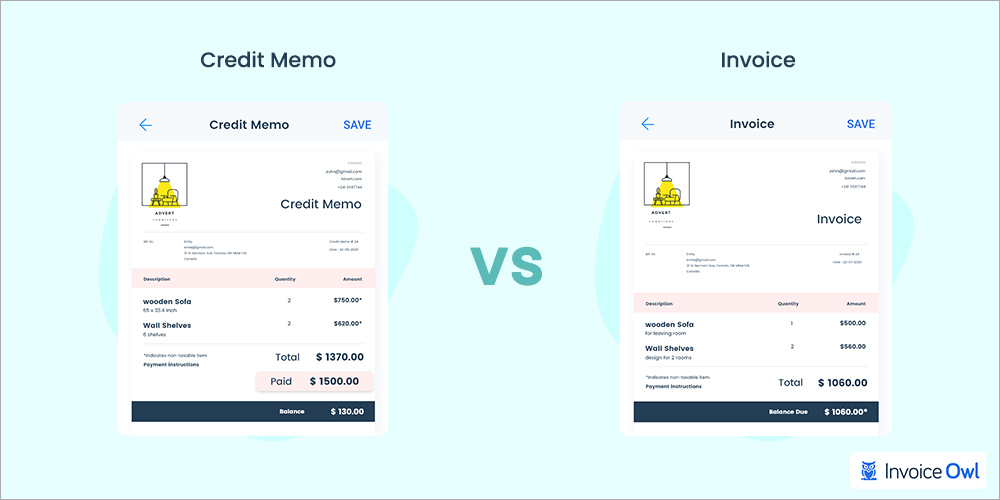

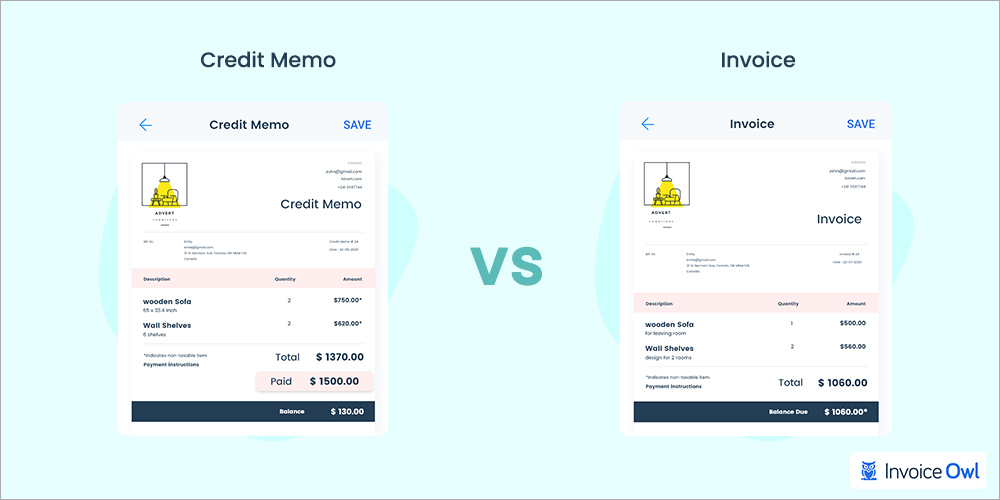

Now that we have discussed credit memos and invoices separately, let’s compare them next to each other and know the difference.

| Criteria | Credit Memo | Invoice |

| What does it show? | A positive balance in the customer’s account. | The amount a customer owes to the contractor. |

| When is it issued? | When the: |

Yes, they have quite a few differences.

But, both have similarities too. And that’s why most contractors are confused between them.

So, let’s talk about the similarities.

| Criteria | Credit Memo | Invoice |

| Who issues it? | Contractor | Contractor |

| Whom is the addressee? | Customer | Customer |

| Is it legally binding? | Yes | Yes |

| Which department handles it? | Accounts payable department | Accounts payable department |

Alright, we have discussed the differences and similarities between both accounting documents. Now, you can easily differentiate between the two and know what to issue and when to.

And just to make sure we cover all your doubts, we have answered the frequently asked questions to help you clarify your doubts if any.

Frequently Asked QuestionsBoth the buyer and the seller must know the difference between a credit memo and an invoice. Especially contractors like you. Because you have to issue the appropriate documents at the appropriate time to be professional.f

So in this blog, we talked about the differences and similarities between a credit note and an invoice.

If this is too overwhelming for you as a contractor, you must try InvoiceOwl —estimating and invoicing software for contractors. You get a free trial without any commitment. So, sign up to InvoiceOwl no to win more jobs and get paid faster.

Author Bio Jeel Patel FounderJeel Patel is the founder of InvoiceOwl, a top-rated estimating and invoicing software that simplifies the invoicing and estimating processes for contractor businesses. Jeel holds a degree in Business Administration and Management from the University of Toronto, which has provided him with a strong foundation in business principles and practices. With understanding of the challenges faced by contractors, he conducted extensive research and developed a tool to streamline the invoicing and estimating processes for contractors. Read More

Get weekly updates from InvoiceOwl.